Mini Manual

![MCj04348320000[1]](pay_cert_mini_manual_files/image002.gif)

Lynda Roesler, Internal Control

Coordinator

Syl Luhring, Payroll Supervisor

27. CERTIFICATION OF PAYROLL – Agencies shall certify each payroll

to State Accounting. The Agency Director

(or designee) shall provide State Accounting with the name(s) of employees who

have authority to certify the agency payrolls on an annual basis. The certification

form shall be completed for each pay period and forwarded by an authorized

person via email using the email link provided on the bottom of the form. The

email address is as.stateaccounting@nebraska.gov

with subject line of Payroll Certification.

The person certifying the payroll must review their Agency payroll to ensure:

·

Payroll

messages have been reviewed and all changes made;

·

Employees

listed are employees of the agency;

·

The

total number of hours and gross pay for the Agency is reasonalble;

·

Journal

entry is in balance;

Reports that may assist you with this review are the Payroll Register (R073012), the Payroll Journal Proof/Edit Report (R05229) and the Payroll Exception Report (R053191). Review the Payroll Certification Mini Manual for recommendations on procedures for certifying the payroll.

PAYROLL CERTIFICATION MINI MANUAL

Steps to follow when certifying agency payroll:

Ø Ensure

employees listed are employees of the agency

Ø Determine

if the number of hours and gross pay is reasonable for the agency

Ø Verify

Journal Entry is in balance

Ø Verify Gross Pay and Net Pay

Using the Payroll Register Report (R073012)

Using the Payroll Journal Proof/Edit Report (R05229)

Using the Payroll Exception Report (R053191)

Using the Payroll Totals Report (R581214)

How to use the Variance spreadsheet tool

Payroll

Certification Form Instructions

Whenever possible the following duties should be

segregated. Anytime duties cannot be

adequately segregated, you should contact State Accounting who will assist you

with developing procedures that are acceptable for good internal controls.

Ø Agency

time keeper - should only be entering time; should not have access to process

payroll.

Ø Agency

payroll clerk – when payroll clerks enter time sheets and process payroll an

agency payroll supervisor must review the work.

Accurately reporting employee’s time is the responsibility of the

approving supervisor. Accurate recording

of the time sheets in NIS is the responsibility of the agency payroll

clerk.

Ø Agency

payroll supervisor - responsible for reviewing payroll entries to ensure

information is entered correctly. They

should always review the time records for anyone who has access to enter,

change, or update a payroll function.

Ø Agency

payroll certifier - responsible for reviewing payroll entries to ensure the

data entered is reasonable for their agency.

This person should always review the records for anyone who has access

to change, update or process payroll.

The Payroll Certifier should have NIS Payroll access in order to review

payroll data on-line, but they should not have access to change or update

payroll records or to process payroll.

Ø Agency

accounting person – responsible for reconciling the payroll to the general

ledger (see

instructions for reconciling). After

the Payroll Certifier has certified the payroll to State Accounting, they will

forward the Payroll Register Report which was used for certification, to the

agency accounting person. The accounting

person conducting this reconciliation should not have access to update or

change payroll, or be the Payroll Certifier.

Ø

Payroll

Certifiers should review the payroll message screen to ensure that all errors

or potential problems have been resolved.

This review should be conducted EVERY TIME the payroll is processed and

the appropriate corrections or adjustments should be made before certifying

your payroll. Usually the agency payroll

clerk or agency payroll supervisor will have corrected these issues but it is

the responsibility of the Certifier to verify the messages have been resolved. If the Payroll Certifier finds a message that

needs resolution, he should contact the Payroll Supervisor.

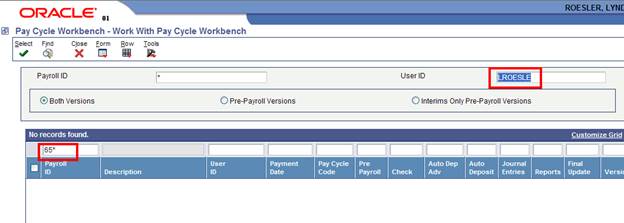

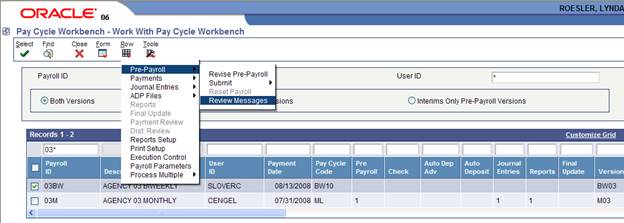

Path: Payroll>Payroll Processing>Pay Cycle

Workbench

Remove

your ID from the User ID field

In

QBE line for Payroll ID enter your agency number followed by an asterisk (*)

Click

on Find

Highlight

the Payroll ID

Go

to Row>Pre-payroll>Review Messages

Below is a list of the most common errors that appear on

the message screen:

·

Autopay Timecard in Error:

Check to make sure the employee’s standard hours worked and that they

have the correct pay. Generally this

error does not lead to any pay problems.

·

Employee has

Gross-to-Net Error: This error MUST be fixed before proceeding

with payroll process. It occurs when the

employee’s gross wages minus the taxes and deductions did not equal the net

wages. Can usually be found on the

payroll register using the Find option.

·

EE Deduction Not

Taken: Employee has insufficient gross pay to cover

all of the deductions. Certain

deductions MUST be paid (i.e. health, dental, etc.). Check to see whether deductions can be made

up next payroll or whether employee must write a check to cover the

deductions.

·

EE Wage Attach

Reduced by Rule: Do not need to worry about this. It indicates the gross pay wasn’t enough to

cover garnishments, liens or child support.

State Accounting is responsible for these items.

·

Terminated Employee

Paid: This indicates that there is an employee on

the payroll with a pay status of 9. In

most cases this is okay, but you should check the employee anyway to ensure

they are not being paid for wages they are not eligible for.

·

Job Does Not Qualify: Indicates that the pay start date is after

the pay period ending date or the pay stop date is before the beginning of the

pay period. This generally shows for new

hires but also shows for a terminated employee that was reactivated for some

reason. If the employee is supposed to

receive wages on the payroll, you will have to correct the pay start/stop dates

in order to pay them.

·

Hours: When entered in

excess or less than the number entered in the Pay On

Standard Hours field, the message will appear warning of the problem. This is not a critical error but one that

needs to be reviewed to ensure accuracy and correctness.

EMPLOYEES

LISTED ARE EMPLOYEES OF THE AGENCY

This

step requires the agency to have procedures in place ensuring that all employees

being paid are current employees of the agency and be able to identify

fictitious employees. The best way to

accomplish this is to review the Payroll Register Report employee by employee. For large agencies this may be a task that

the certifying person may receive help with from other employees. The key is to get two or three independent

people involved. There must be a clear

separation of duties – which means the people assisting with the review should

not have access to make changes or process payroll. For large agencies, we understand the final

certifying person may not be familiar with all employees. However a cursory review for reasonableness

must be undertaken. During the

certification process, the certifier should have a reasonable expectation of

how many employees should be paid, the number of working hours for their

agency, and the expected dollar amount of the payroll. (See also Hours/Gross Pay

and Variance Spreadsheet)

The

Agency should have a procedure documented and followed whereby upper Payroll

Management does a face-to-face with randomly selected

employees on a regular basis.

THE

NUMBER OF HOURS AND GROSS PAY IS REASONABLE

The Payroll Certifier should review the hours

worked and the gross pay for each employee to determine that they are

reasonable. This can be done by

reviewing the Payroll Register and looking at the total hours and gross pay for

each employee. Please see Understanding

the Payroll Register Report for instructions on how to find this

information.

Large Agencies

For large agencies that have hundreds of employees, there

are three tools which will assist in verifying the number of hours and gross

pay: the Payroll

Register Report (use the pages which lists total hours/gross pay by Home

Business Unit), the Variance Spreadsheet and the Payroll Totals Report. In addition to reviewing staff that have

access to change or update payroll, the Payroll Certifier should randomly

select an appropriate number of employees and review the time entered for those

employees. These randomly selected

employees should be different employees each pay period.

Example of how to randomly select employees

An agency with 800 employees may determine to review 10

randomly selected employees each pay period.

If the Payroll Register report is 400 pages long the Payroll Certifier

should look at one employee on every 40th page (that is one employee

on page 40, one on page 80, one on page 120, etc.) to determine if the

employee’s total hours are

reasonable. This review should be

documented with a tic mark and the initials of the Certifier. For the following pay period, to ensure a

random selection of employees that are different from the last pay period, the

Payroll Certifier can begin on page 3 and then select every 40th

page (page 43, page 83, page 123, etc.)

For the next pay period the Payroll Certifier can begin the random

selection on page 7.

Using the Payroll Totals Report: If the report is 50 pages long, the Payroll

Certifier should look at one employee on every fifth page. Choose a random number, such as 13, and then

review every 13th employee on every fifth page (page 5, 10, 15, 20,

etc.). For the following pay period, to

ensure a random selection of employees that will be different from the last pay

period, The Payroll Certifier should choose another random number, such as 9,

and begin the review on page 4 (review the 9th employee listed on

page 4, 9, 14, 19, etc.). The Certifier

should use a tic mark to identify the employee selected,

and also initial and date the report.

If an Agency chooses to review the pdf report instead of printing

out a hard copy, a spreadsheet should be created that the Payroll Certifier may

initial to show this review was completed with an explanation of how the review

was conducted.

The procedure used by each Agency to randomly select

employees for review should be documented and is subject to review and approval

by State Accounting.

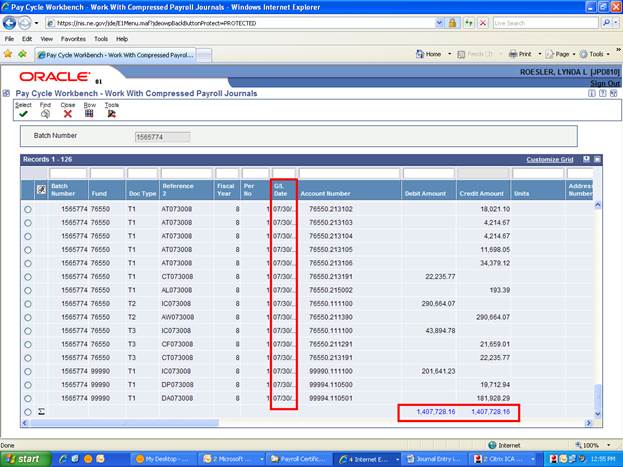

PAYROLL JOURNAL ENTRY IS IN BALANCE

This

procedure should be done by payroll clerks and payroll supervisors, but it is

the responsibility of the Payroll Certifier to verify the Journal Entry is in

balance before certifying the agency payroll.

IF THE DEBITS AND CREDITS DO NOT BALANCE, THE PAYROLL CERTIFIER WILL BE

CONTACTED BY STATE ACCOUNTING.

If

the JE is not in balance (debits and credit columns must be the same number) or

if the dates are not correct, contact the Agency payroll supervisor to have the

payroll reset.

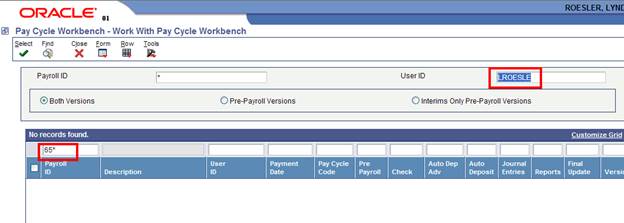

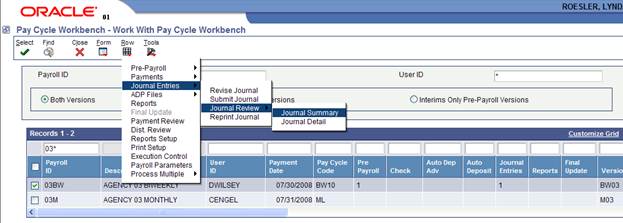

Path: Payroll>Payroll Processing>Pay Cycle

Workbench

Remove

your ID from the User ID field

In

QBE line for Payroll ID enter your agency number followed by an asterisk (*)

Click

on Find

Highlight

the Payroll ID

Go

to Row>Journal Entries>Journal Review>Journal Summary

Scroll to the bottom and verify the Debits and Credits

are in balance

The GL date must be the same as the pay date

(check date)

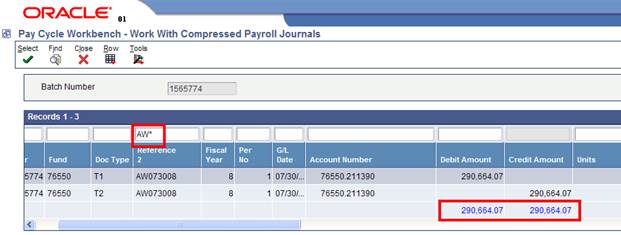

On the QBE line, in the field named Reference 2 enter AW*

(must be caps) and click on Find

Debits and Credits must be in balance.

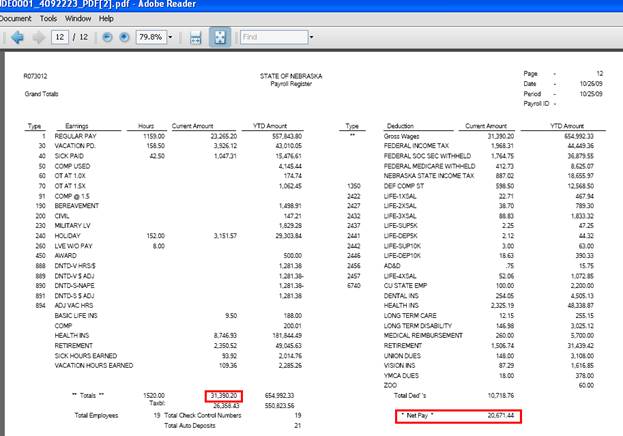

The payroll certifier is

required to verify the gross pay and the net pay on the payroll register agree

to the amounts in the Journal Entry created in E1. If either of these two amounts do not agree the cause must be determined and corrected

before payroll is certified. Contact

State Accounting if you need assistance in resolving the issue.

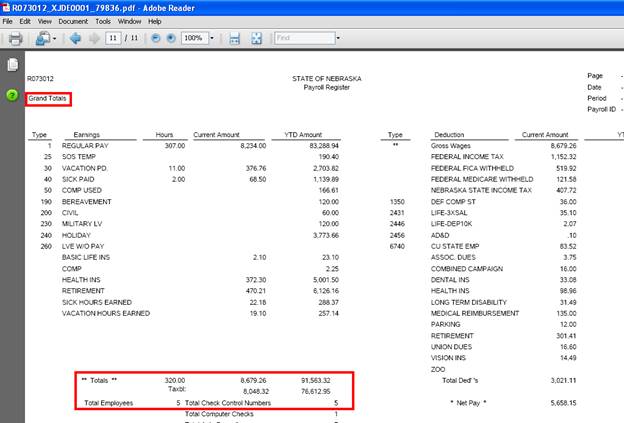

The two amounts that need to be reviewed are

on the last page of the Agency’s payroll register and are shown in the screen

shot below in the red boxes.

Review these two amounts on

the payroll register to ensure they agree to the journal entry in NIS.

NOTE:

If you are conducting your review in the order identified in the Payroll

Certification Manual, you will be in the correct screen (Pay Cycle Workbench - Work With

Compressed Payroll Journals) to conduct this next

step. You will not need to Close your

current window and follow the path shown below.

You may skip down to the next section that begins “Enter T1 on the QBE

line”.

Path: Payroll>Payroll

Processing>Pay Cycle Workbench

Remove your ID from the User ID field

In QBE line for Payroll ID enter your

agency number followed by an asterisk (*)

Click on Find

Highlight the Payroll ID

Go to Row>Journal

Entries>Journal Review>Journal Summary

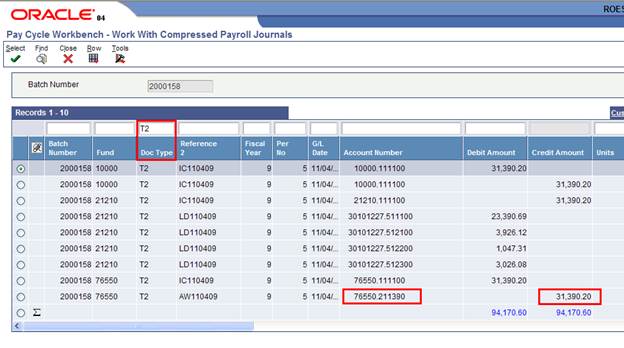

Enter T1 on the QBE line for Document

Type

Click Find

Scroll to the bottom

To verify the Net Pay, review the

credit amount for BU 99994.110501 (Payroll EFT)

and

BU 99994.110500 (Payroll Warrants)

Verify the amount agrees to the amount

on the payroll register

Enter T2 in the QBE field for Document

type

Click Find

Scroll to the bottom

To verify the Gross Pay, review the

credit amount for BU 76550.211390 (accrued wages)

Verify the amount agrees to the amount

on the payroll register

NOTE: if the agency does not have many lines of

coding, you may not need to put the T1 and T2 in the QBE line. You may be able to scroll to the bottom of

the screen and find the amounts to verify.

Be sure that you are verifying the amounts associated with the Business

Units shown above.

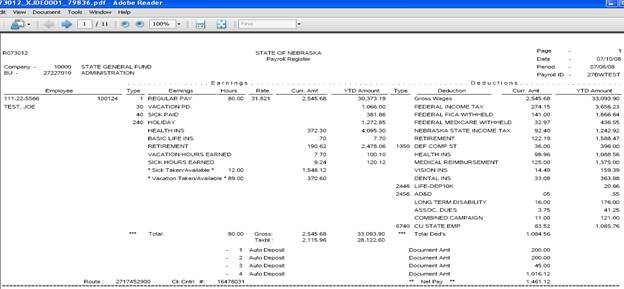

USING THE PAYROLL REGISTER – R073012

The payroll register is the keystone of reports generated

during payroll processing and must be used in validating payroll. The report is built in three sections

–individual information, Home Business Unit (HBU) summaries and a grand totals

page at the end.

The first section, by individual, provides a summary of

the hours, pay rate, gross pay, deductions, taxes,

total hours worked for period, as well as vacation and sick leave accrual

information. There is also information

regarding the warrant / auto deposit process and the check routing information. The section is used primarily by the payroll

clerk during payroll setup and processing as a proof for information entered

for the employee.

To search for issues open your report, place your cursor

on it and click control F. That opens

the Find box in the upper right corner.

Enter the word ERROR

and click enter or use the arrows in the box to search the document, then enter

the word WARNING

and search the document. If either is

found they will need to be corrected before certification can continue.

![]()

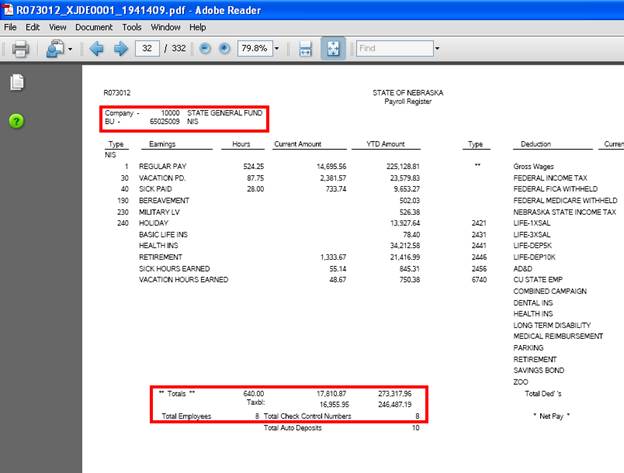

Section two, the summary by HBU,

provides the same information as section one but on a summary basis for each

home business unit. This section is used

as a cursory summary for the payroll clerk but may be used more often by the

accounting department or the Payroll Certifier.

From this page, the Certifier can check the total number of employees

being paid in the cycle and for reasonableness of the total number of hours and

wages paid to the employees of this HBU.

The third section, found on the last

page of the report, is the Grand Totals page.

It provides the grand totals for every individual paid in the period,

for every HBU addressed in the process, tax information and deductions. This page is used to balance the entire

process and is a good reference point for the individual certifying the

payroll. From this page, the certifier

can check the total number of employees being paid in the cycle and for

reasonableness of the total number of hours and wages paid to the employees of

the agency.

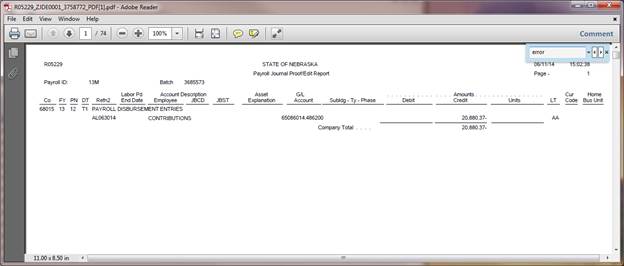

USING THE PAYROLL JOURNAL PROOF/EDIT REPORT - R05229

This report is designed to check for errors in the

journal entries made while processing payroll.

To check for problems or issues in the report, open the

PDF of the report. To search for issues open your report, place your cursor on

it and click control F. That opens the

Find box in the upper right corner.

![]()

In the search box,

type the word “error” and press enter.

If errors exist, the search will stop at each location where the word

“error” appears in the document. You may

also use the forward/back arrows in the search box. These errors are normally corrected by the

agency payroll clerk, but it is the responsibility of the Payroll Certifier to

ensure all errors have been resolved before certifying agency

payroll. If a Payroll Certifier finds an

error on the report, they should contact the agency payroll supervisor.

Errors usually occur when the Home Business Unit.Object code is set up incorrectly or not at all. Another cause for errors is the incorrect

journal date entered or the Auto deposit date (start of deposits) listed in the

future. This error would appear as an

out of balance condition.

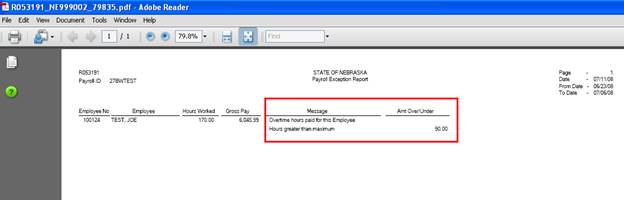

USING THE PAYROLL EXCEPTION REPORT – R053191

The payroll exception report displays any exceptions to

the normal payroll entry process. It

encompasses problems with hours worked (greater or less than the established levels),

overtime paid, wages paid (hours or wages greater than or less than the

established levels), or any other areas where amounts exceed or are grossly

less than established levels. These

entries are informational in nature but should be reviewed for reasonableness

before payroll is certified.

USING THE

PAYROLL TOTALS REPORT – R581214

The Payroll Totals Report will assist Payroll Certifiers

in conducting a review of employee hours and gross pay. This report runs automatically when

pre-payroll is processed. To review the

report, Payroll Certifiers should scan down the columns for Hours and Gross

Pay. This will quickly allow the

Certifier to determine if the hours and gross pay shown is reasonable for the

employee.

This report can also be used by the Payroll Certifier to

randomly select employees for verification of total hours and gross pay. (Please refer to section on NUMBER OF HOURS

AND GROSS PAY IS REASONABLE).

HOW TO USE THE VARIANCE SPREADSHEET TOOL

|

This

spreadsheet is usually completed by the agency payroll clerk or the agency

payroll supervisor and forwarded to the agency payroll certifier for

review. Entering the correct data in

this spreadsheet can assist agencies in determining if their payroll is

reasonable. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

The

information for this analysis is drawn from the payroll register for each pay

cycle. This speadsheet

should be saved for each pay cycle.

When conducting the analysis information (highlighted below) for a new

pay period, be sure to delete the old information and resave the spreadsheet

with a new name. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Column

B (Total # of Employees) and column C (Total Payroll Amount) come from the

grand totals page of the Payroll Register Report. |

||||||||||

|

Report. |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Columns

D through I come from the summary by home business unit pages(s) of the

Payroll Register Report. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Payroll Variance

Analysis |

||||||||||

|

Pay

Cycle |

Total

# of Employees |

Total Payroll Amount |

Sum

total of BU's Equals Total Payroll Amount |

|||||||

|

Business

Units |

|

|||||||||

|

99110001 |

99000003

|

99000006 |

99000004 |

99000005 |

99000000 |

|||||

|

B-1 |

81 |

$

96,917.97 |

$ 3,649.88 |

$ 13,757.02 |

$ 3,239.29 |

$ 61,443.92 |

$ 12,932.90 |

$ 1,894.96 |

$ 96,917.97 |

|

|

B-2 |

80 |

$ 109,557.48 |

$ 3,649.88 |

$ 13,555.52 |

$ 2,259.92 |

$ 75,340.25 |

$ 12,856.94 |

$ 1,894.97 |

$ 109,557.48 |

|

|

B-3 |

81 |

$ 102,440.74 |

$ 3,649.88 |

$ 13,755.02 |

$ 2,749.59 |

$ 67,548.15 |

$ 12,843.13 |

$ 1,894.97 |

$ 102,440.74 |

|

|

B-4 |

90 |

$

97,710.68 |

$ 3,649.88 |

$ 13,306.61 |

$ 2,769.13 |

$ 59,354.77 |

$ 12,931.26 |

$ 1,894.97 |

$ 93,906.62 |

|

|

B-5 |

81 |

$

92,368.21 |

$ 3,821.82 |

$ 13,300.02 |

$ 2,814.85 |

$ 57,463.24 |

$ 13,073.32 |

$ 1,894.96 |

$ 92,368.21 |

|

|

B-6 |

83 |

$ 105,399.37 |

$ 3,942.17 |

$ 16,144.88 |

|

$ 71,345.42 |

$ 12,101.92 |

$ 1,894.98 |

$ 105,429.37 |

|

|

|

|

|

|

A |

A |

B |

C |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

Combined 2 employees from 99000006

with 99000003 |

$ 2,844.86 |

|

|

|

|||||

|

B |

Overtime expense for storm clean

up + 2 new employees |

$ 13,882.18 |

|

|

|

|||||

|

C |

Employee on LWOP |

|

|

|

$ 971.40 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of employees = Total Check

control number from payroll register |

Yes

/ No |

|

|

||||||